Reduced Costs

When calculating the expenses of building a card issuing wallet, or integrating an existing wallet with a payment processor, you should consider both the monthly expenses and the time it takes to finish development. Nautilus cuts down on both.

Requirements for card issuing wallet

Developing a card issuing wallet from scratch means integrating with several principal providers:

- Payment processor – providing connectivity to card network(s), doing basic transaction processing and passing transaction data to the wallet for final processing,

- Physical card production company,

- BIN sponsor – providing a range of card numbers to be used,

- KYC provider – provides services related to customer identity verification and other related security checks.

- The wallet itself that keeps balances and has a back-office that is used by employees,

- The customer facing application (In these days, it is mostly mobile, maybe web front-end as well)

How to build it

The most logical order is to start with the very core of the system, i.e. with the wallet system. The basic idea would be: “let’s first create the core of the system, because it doesn’t depend on anything else, then we add the external services, adding the most expensive ones just before we go live, so we don’t have to pay for them before we really use them”.

Unfortunately, when it comes to building digital wallets that is not possible. The first problem is that the most expensive external service is the payment processor, which also provides transaction data, on which the wallet directly depends, so to build the core of the system you need to have the services of a payment processor.

Next problem is that the payment processor will, usually, ask you to have a contract with a BIN sponsor, prior to signing a contract with you – which adds the BIN sponsor to prerequisites as well.

A KYC provider will be required by the regulators in charge, and they might suggest a list of KYC providers that you can use (you can usually go with somebody else, but in that case, the KYC provider will also need to get approved from the regulator).

The card production companies are usually the least of the problems – you don’t really need them before you go live, they are relatively easy to replace, and they are usually not expensive.

Costs (without Nautilus)

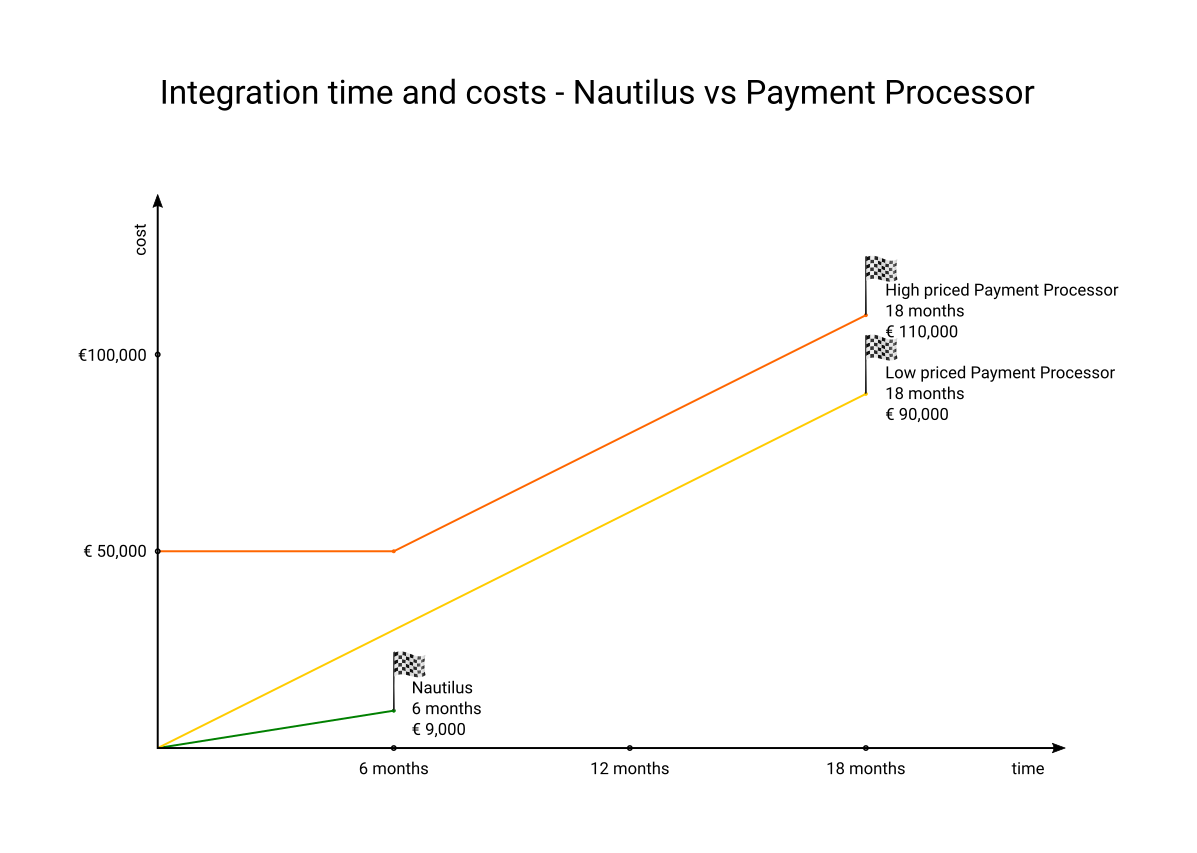

Payment processors usually have two different models to charge for their services:

- Setup fee (~€50,000+), which provide you with their services for free for some time (~6 months), after that you need to pay a monthly fee (~€5,000)

- Monthly fee (€5,000+) during development, higher fees once you go live

The BIN sponsor onetime fee costs over €20,000, and after that, €2,000 to €3,000 each month. Some payment processors will not ask for a BIN sponsor during development, which makes this cost avoidable.

Since you need to start the development with the wallet, you should be aware that you have to continue paying for the payment processor while you work on the integration with the KYC provider and while you are awaiting licenses.

The optimistic average time required to complete the development and integrations is around 18 months (about 1 and a half years) - the cost for 3rd party services is at least €90,000, more realistically around €150,000.

Nautilus cuts down expenses

If you decide to use Nautilus during development, you can easily remove the payment processor and BIN sponsor costs from the list of expenses.

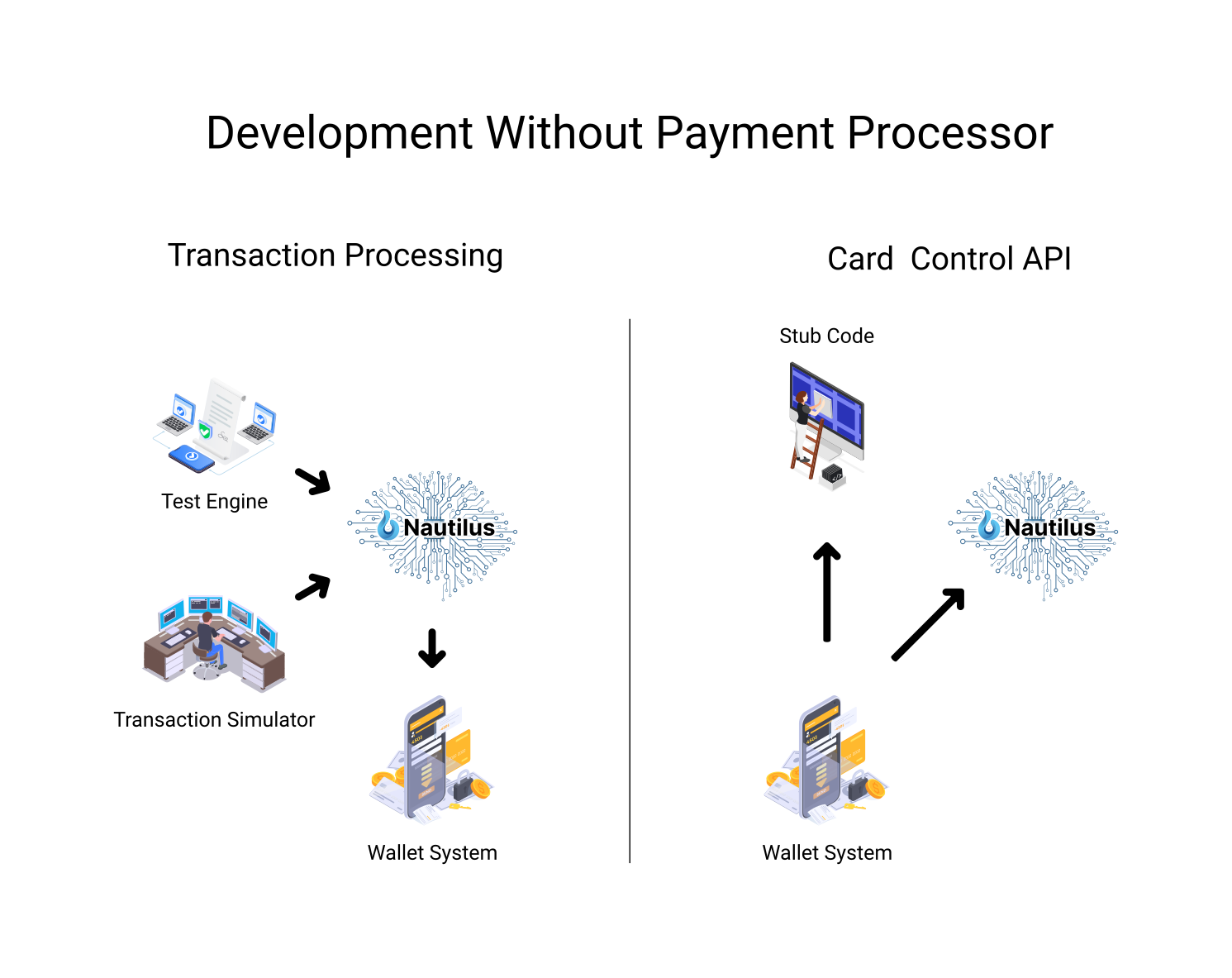

Further, if you use Nautilus, its simplified interface and additional tools such as transaction simulator and test engine speed up integration significantly, allowing you to cut the integration time down to 3 to 6 months. As Nautilus handles significant aspects of transaction processing, there are processes you don't need to incorporate into the wallet, such as transaction matching (i.e. pairing settlements with authorizations) or calculating full effects of the transaction on the card balance. This significantly reduces the scope of the work required for the wallet.

While using Nautilus to develop your wallet, you can test your system as much as you want. This doesn’t require real money or real cards – in fact it doesn’t even require having a payment processor connection – you can complete most of your development without a payment processor.

Once you fully develop your product, you still need to connect to a payment processor and a BIN sponsor, but rather than paying for a year and half of services that you will not be using, you will only pay for a minimal time of pavement testing, which would probably be less than 3 months (depending on the payment processor). This is possible through Nautilus’s seamless connection of your system to the payment processor of your choice, once you go live.

With Nautilus you cut time to market in half (or even more), and you cut your expenses by at least 60%.

No maintenance

Once the system is in production, periodic updates to your integration with the payment processor may be necessary to accommodate changes in transaction data introduced by payment processors over time. Nautilus eliminates this expense for you. We ensure the stability of the interface you use to connect to Nautilus, guaranteeing that all payment processor integrations between Nautilus and the payment processors are up to date.

No manual handling of transactions

The Nautilus interface is designed to handle all possible situations that arise from using payment cards. It is structured to facilitate automated processing. This means there is no need to manually import and rectify the impacts of non-standard transactions that occur every day. Nautilus core processes all possible corner cases and translates them into the same data structures as any other transaction, making it easy for wallets to automatically handle even corner case transactions.