Reduced risk

Wallets using Nautilus avoid both pre-production and in-production risks.

Risk of choosing the wrong provider

One of the biggest risks in developing a digital wallet is the potential selection of the wrong critical service providers, such as the payment processor or KYC provider, or developing a product tailored for a specific jurisdiction and later discovering issues with launching it there. These mistakes can lead to substantial costs and significant delays in rectification. To minimize associated risks, it's crucial to keep options open for as long as possible. This involves fully developing the product before finalizing contracts with service providers or ensuring the product's compatibility with multiple territories.

However, given that significant components of a wallet system rely on transaction data from the payment processor, many digital wallets cannot afford to delay the selection of this critical component. This lack of flexibility exposes their business to various associated risks.

With Nautilus, most of the products can be developed without any payment processor or BIN sponsor connection (also resulting in significant money savings for not paying high fees before going live). You can postpone the commitment to a specific payment processor until you are ready to launch, with the assurance that even if you make a mistake, you can also easily substitute it for another provider.

Be able to migrate if needs be

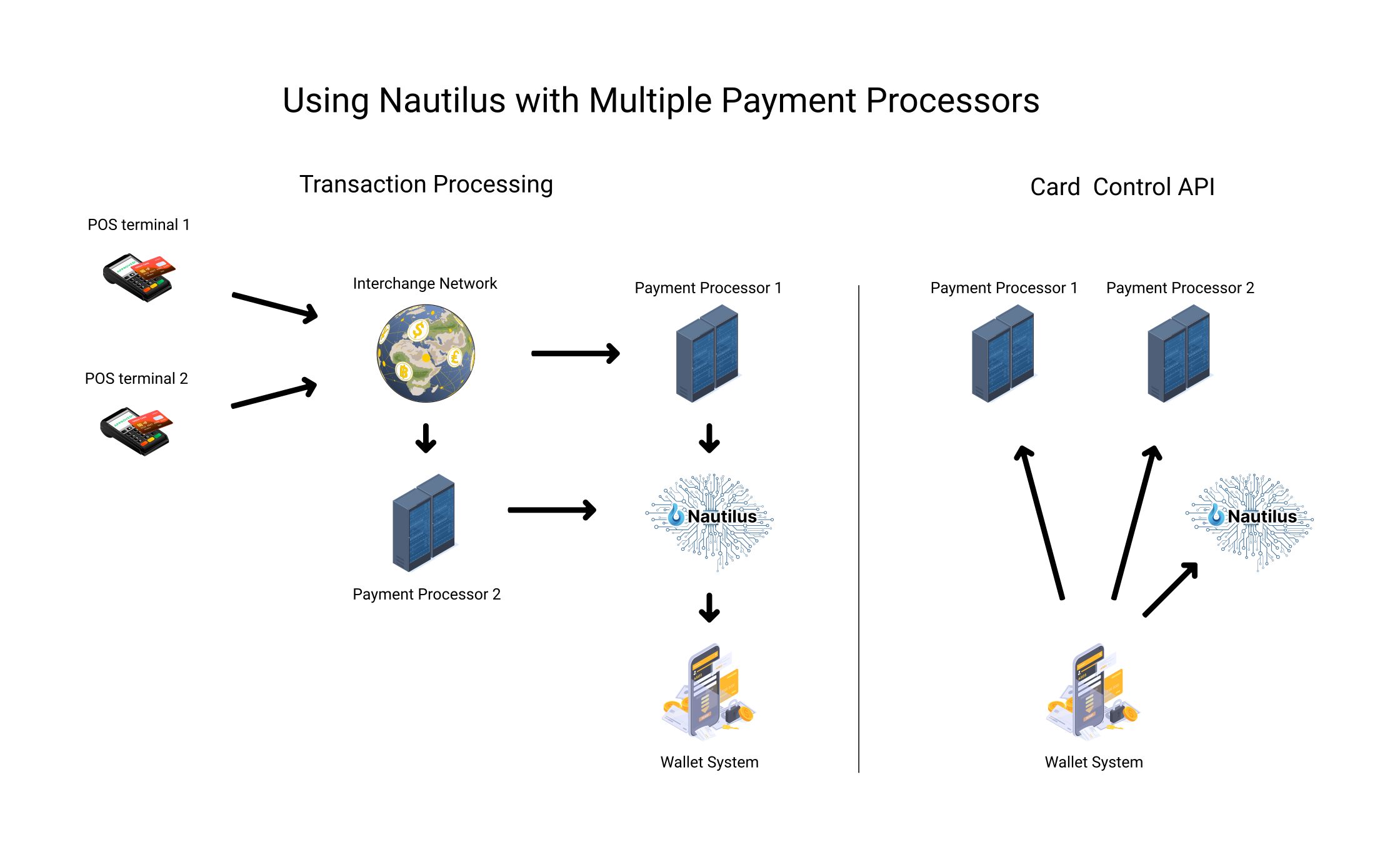

Integration with Nautilus is payment processor-independent, ensuring a seamless transition when replacing a payment processor. All Nautilus integration remains unchanged, requiring only a quick modification of the code for controlling cards (which is usually done very quickly).

Risk of errors in the wallet behavior

Once in production, the most significant and potentially hazardous risk is the incorrect processing of transaction data by the wallet. While this may seem unlikely, it occurs frequently, especially with corner case transactions or non-standard transactions. The reasoning behind this is: corner cases are relatively rare, occurring in only a few percent of cases, or even less frequently; if the wallet effectively handles 99% (or 99.9%) of situations, there's typically no cause for concern.

However, the sheer volume of data that a wallet must handle makes this reasoning a very dangerous one. For instance, a wallet with 50,000 active cards (considered small to normal) could receive approximately 35,000 authorization requests and nearly 30,000 settlements daily, totaling 65,000 transactions. Even a 1% mishandling rate results in 650 transactions per day, a potentially significant number. With a 0.1% error rate, there are still 65 mishandled transactions daily. Adding to the complexity, when a transaction is mishandled, detection may not occur immediately. By the time a mishandled transaction is identified, there may already be thousands of transactions that have been handled in the same way.

What is the best way to be as sure as possible that something like this won’t happen to you? Test as much as you can and make sure you are handling all corner cases as well. While in production keep monitoring your system closely every day.

Thankfully, Nautilus excels in addressing these challenges. It features a built-in simulator for corner cases, and its test engine can generate extensive regression test suites for thorough system evaluation. Additionally, the Nautilus protocol, offering pre-calculated transaction effects, is designed to be as unambiguous and easy to process as possible. It is also resilient to protocol violations and invalid transaction data coming from acquirers. Once you are in production you can also monitor Nautilus’ wallet health and business reports to be alerted as soon as possible about any discrepancies between Nautilus and wallet reports.